Are you ready for the PSD2 September deadline?

The PSD2 directive is a policy put into place by the EU in recent years to encourage banks to adopt more modern, efficient, and secure practices. The directive has included; making stronger customer authentication mandatory and opening up banking platforms to third-party services.

The new PSD2 regulations have put banks on a fast track to adopting and implementing the latest and greatest technology in their banking services. Unfortunately for banks, the deadlines put pressure on institutions to keep compliant.

How PSD2 is changing this September

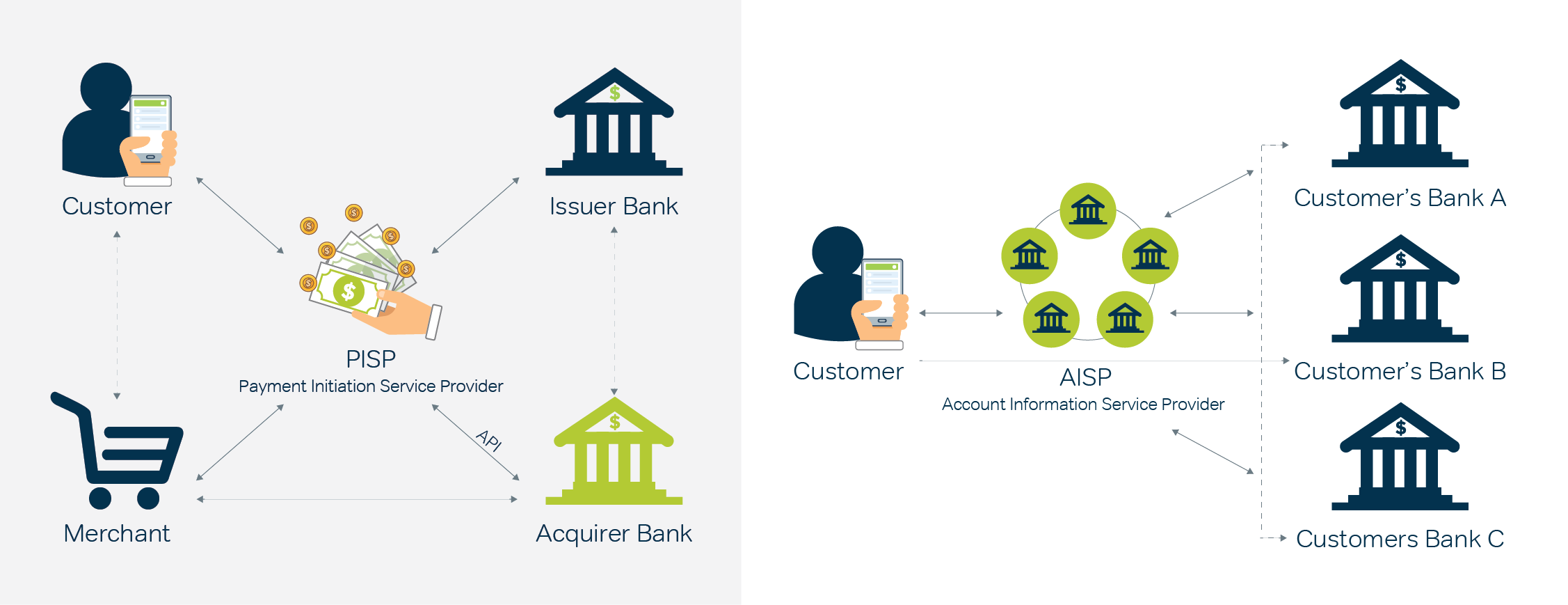

The deadline is this September, and it introduces changes for banking institutions in the EU. The differences with this new deadline centre around open communication with banks to third-party services, primarily through APIs.

This will make it easier for financial apps and services like Venmo, Intuit, and PayPal to interface with banks. APIs give banks and third-party vendors greater flexibility and security when working together, as well as keeping things simple and fast for customers.

(The New PSD2 Payment models with PISP and AISP)

Security concerns surrounding the new regulations

The PSD2 directive is an exciting proposition for banks, third-party services, consumers alike. The changes coming this September are not without their concerns, especially when it comes to security.

Banks, more so than just about any other institution, are at high risk for being the target of criminal activity. Banks not only have to protect their finances, but also the finances of their customers. This includes guarding against attacks from hackers and digital fraudsters. These days, banks need not just a physical vault, but a digital one, too.

What makes the incoming PSD2 regulations a potential security risk is that it requires banks to open their digital vault to third-party services. This means that even if a bank's security is as tight as it can be, a vulnerability in a third-party's security could put a bank's security in jeopardy by proxy.

In other words, giving a key to third-party services means you're relying on them to hold on to that key as securely as you would.

How to keep your business secure during third-party transactions

Happily, there are ways to keep your customers' data secure during third-party interactions. Implementing these techniques will greatly reduce the chances of fraudsters being able to abuse the upcoming PSD2 regulations.

- First, make sure that you are using strong two-factor authentication. 2FA is far from bulletproof, so the stronger it is, the harder it will be for hackers to take advantage of third-party transactions.

- Second, your bank can partner with mobile network operators. MNOs act as a ‘middle-man’ of sorts for your third-party transactions. This means that, when you partner with an MNO, all of the interactions between your bank and third-party services will first pass through the MNO, allowing them to implement extra security measures. This makes it much, much more difficult for fraudulent activity to slip under your radar.

JT offers several security services that will help protect your banks and their customers. Our services protect financial institutions from threats like fraud, theft, and data mining. We use network-privy information like a consumer's geographic location and SIM card history to determine if the incoming third-party transaction is legitimate.

Our APIs are fast and seamless, so you can provide extra layers of security to your service without inconveniencing your customers.

(JT's role in PSD2 new payment models)

How to avoid missing the deadline

If you're worried about keeping your institution's data secure while also meeting the September deadline, consider partnering with JT. We can use our industry experience to expedite the security measures for your bank so that you can remain PSD2 compliant and digitally secure.

To help you prepare for the new requirements, our team of experts prepared a white paper on the impact of PSD2. It covers everything you need to know about the changes the new directive brings, how they might affect your business, and any measures you should take to keep your business as secure as possible.

Categories